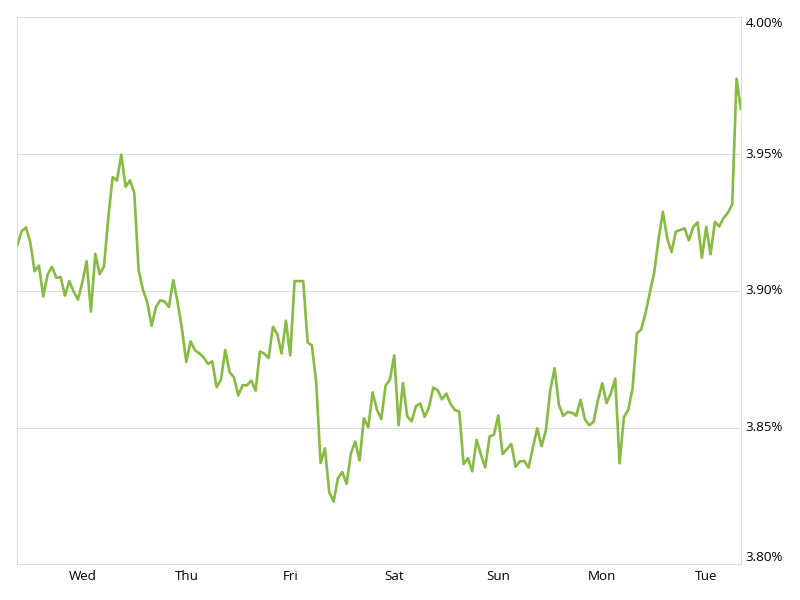

Calculate refinance savings at varied term lengths. As of late-July 2022, the average national interest rate for a 30-year, fixed-rate mortgage was in the mid 5 range. If higher payments are manageable and paying off your loan faster and for less interest are priorities for you, then a 15-year mortgage may make sense for your situation. But monthly payments are higher for 15-year loans.

Refinancing to a 15-year fixed-rate mortgage will cost less interest over the life of the loan than a 20-year mortgage of the same loan amount. Should I refinance to a 15-year or 20-year mortgage? Calculate refinance savings at varied term lengths. If higher payments are manageable and paying off your loan faster and for less interest are priorities for you, then a 20-year mortgage may make sense for your situation. But monthly payments are higher for 20-year loans. Refinancing to a 20-year mortgage will cost less interest over the life of the loan than a 30-year mortgage of the same amount. Should I refinance to a 20-year or 30-year mortgage?

A 5-year ARM, or adjustable-rate mortgage, has a fixed interest rate for an initial period of 5 years then adjusts for the remaining length of the loan - meaning the monthly payments can increase (or decrease) after the first 5 years. Monthly mortgage payments remain the same, while principal and interest totals vary with amortization throughout the life of the loan.

#20 YEAR MORTGAGE CALCULATOR FULL#

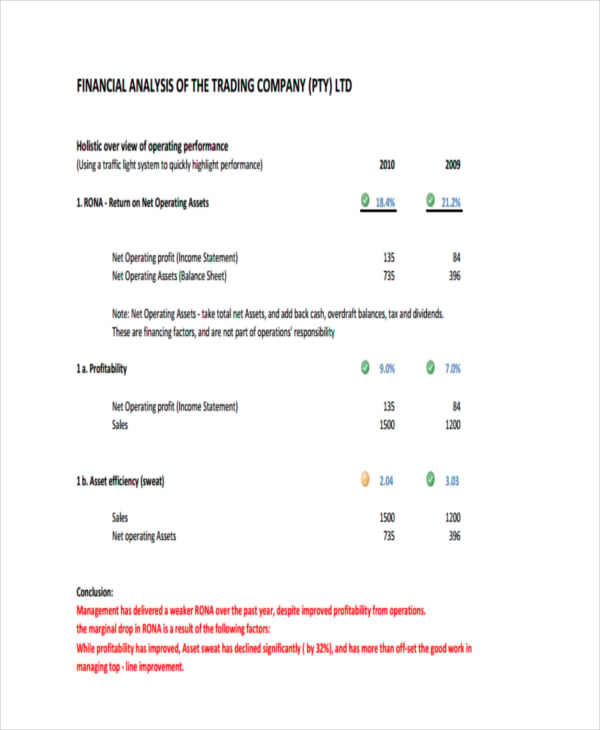

How does a 20-year fixed-rate mortgage compare to a 5-year ARM?Ī 20-year fixed mortgage has a flat interest rate for the full 20 years. Because the loan amount and interest rate stay the same, principal and interest payments remain flat for the 20-year term. For example, on a 20-year mortgage for a home valued at $300,000 with a 20% down payment and an interest rate of 3.75%, the monthly payments would be about $1,423 (not including taxes and insurance). For a 250,000 home, a down payment of 3 is 7,500 and a down payment of 20 is 50,000. A 20 down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase your affordability. Most home loans require a down payment of at least 3. Learn more about 20-year mortgages What is a 20-year fixed-rate mortgage?Ī fixed 20-year mortgage is a loan lasting for 20 years, or 240 monthly payments, with an interest rate that stays consistent for the duration of the loan. The amount of money you spend upfront to purchase a home.

0 kommentar(er)

0 kommentar(er)